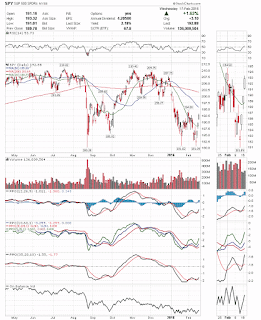

I was bullish before Non Farm Payroll but obviously I was wrong. SPY sold off sharply after NFP and put sellers scrambled for delta hedge.

|

| SPY 5min |

Now SPY sits under declining 5SMA and it's not a good sign for bulls. It is encouraging that RSI/PPO/PMO shows some degree of positive divergence.

|

| SPY OI 2016/02/12 |

SPY's OI is skewed to Put side this time. It's been a while the market started to decline. Bearish articles are everywhere. Any charts look like head and shoulder. It's no wonder many traders loaded up with Puts. My question is... are those puts rewarded again?

I would like to take

@verniman's

Full Wagon Theory this time. The bear's bus may be a bit crowded.

|

| SPY DWV 2016/02/12 |

|

| SPY Options Big trades |

While the market kept declining on Friday, big option traders were buying up Calls, and after market closed, someone bought 10000 of SPY 02/12 191.00C. This is a $1M bet, and I'm biased to bull side this week.